There has never been more over indebted people on the European continent than in 2018. Luxembourg, a country among the richest, seems far from this concern. Nonetheless, the Grand-Duchy is not left unscathed; despite high salaries, the living cost and especially the real estate prices are particularly high. Although the vast majority of over indebtedness people are disadvantaged members of society, it also affects employees and senior executives.

The consequences of over indebtedness are humanly and economically dramatic but the taboo existing on this subject makes them difficult to quantify. Still, many stakeholders are affected : associations and social offices which manage the files, employers who deal with their employees’ wage withholding or even companies which face unpaid dividends. Over-indebtedness therefore is subject of concern and the numerous actors involved have to mobilize and act in a harmonised way in order to tackle this social issue.

The main issues

- A complex subject that requires a holistic approach

- A preventive approach not sufficiently efficient due to the lack of collaboration between actors

- A taboo subject and a stereotypical image of over indebted people

- Lack of financial literacy among the Luxembourg population

Our approach

We believe that private companies, public organizations and social and solidarity-based companies would benefit from a more collaborative approach to tackle the issue of over indebtedness at each stage : from prevention to support for people in financial distress.

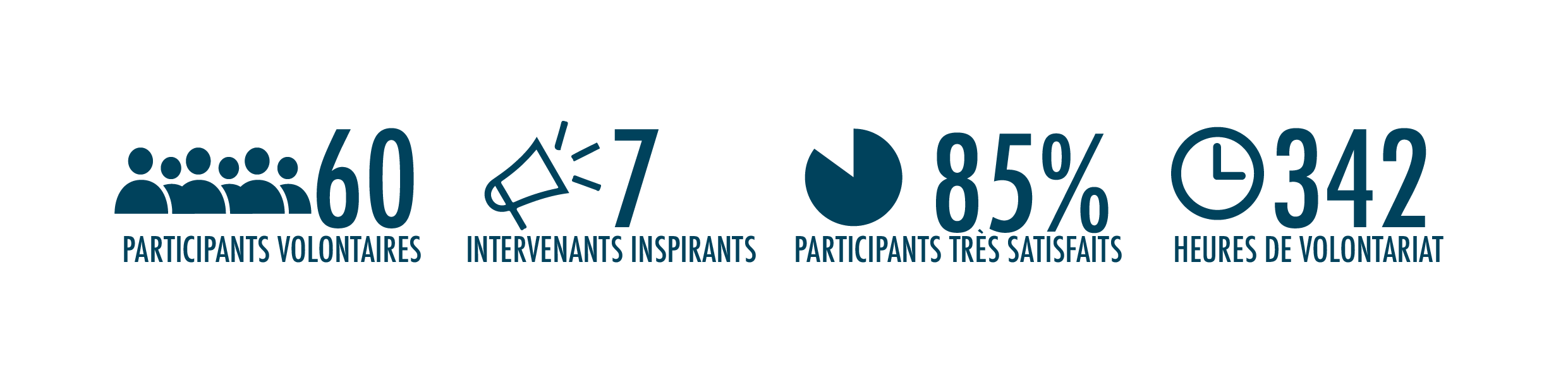

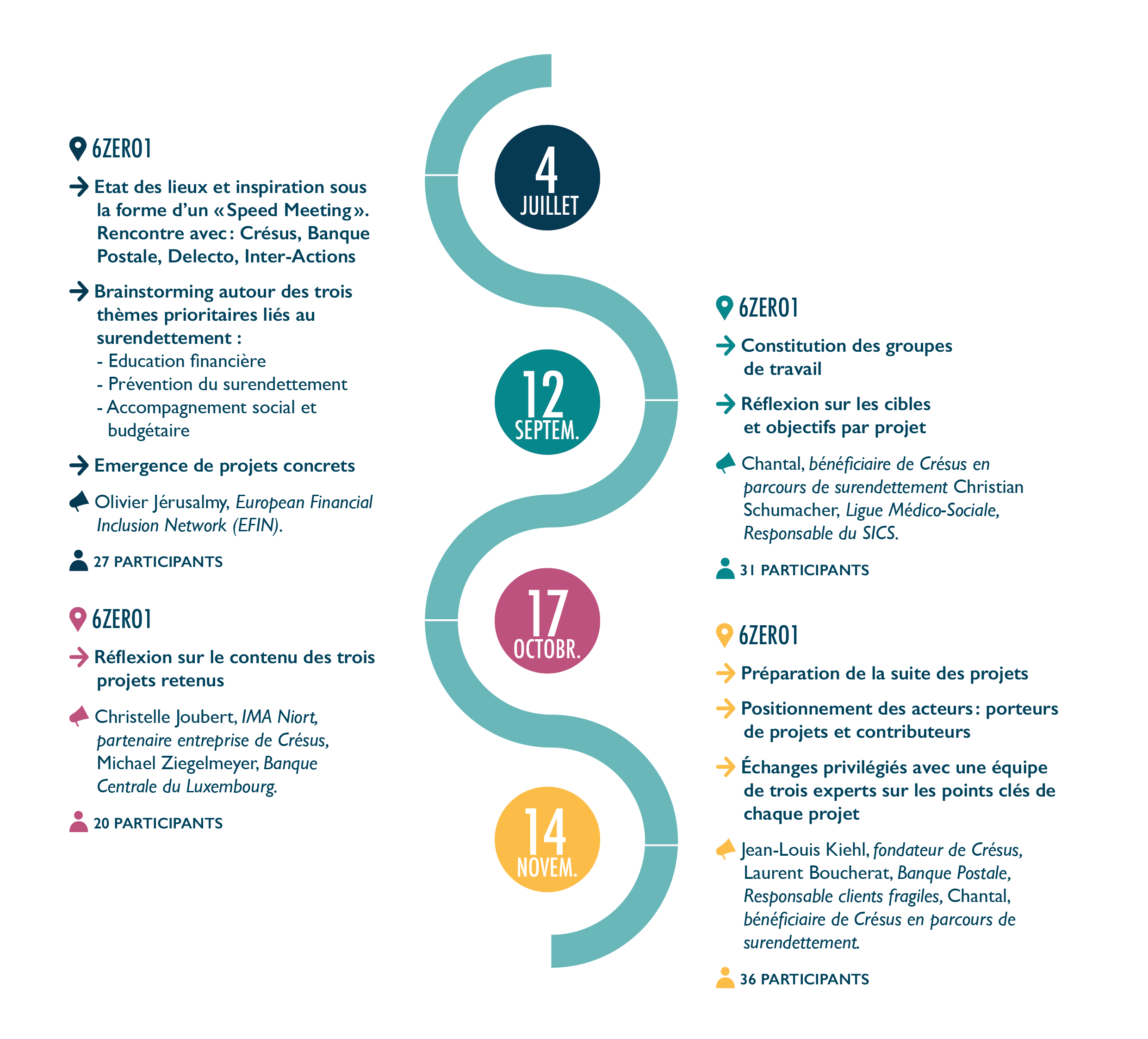

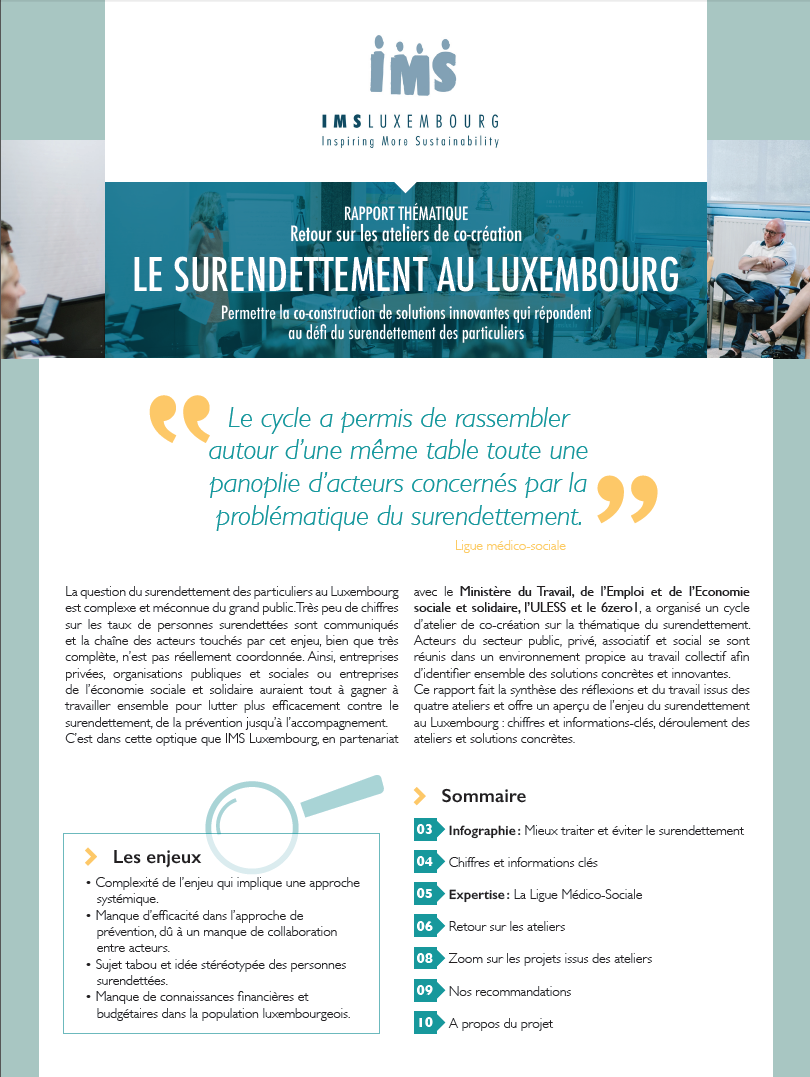

It is from this perspective that IMS Luxembourg, in collaboration with the Ministry of Labour, Employment and the Social and Solidarity Economy, the ULESS and 6zero1, organised a cycle of co-creation workshops on the issue of over-indebtedness. IMS member companies, social companies, non-profit organizations and public organizations gathered in an environment conducive to collaborative work and together they imagined concrete and innovative solutions.

For more informations, please contact Priscilia Talbot.

![]()

![]()

![]()

![]()

![]()

![]()

In order to maintain the dynamic initiated in 2017 during the co-creation cycle, IMS Luxembourg has launched a new inter-company working group specifically dedicated to the prevention of over-indebtedness.

In complementarity with existing actors and solutions in Luxembourg, the group is addressing the challenges of early detection of people in financial difficulties and budgetary and financial education.

The aim of the group? To collectively design solutions adapted to the Luxembourg situation meeting the expectations and needs of companies affected by over-indebtedness.

Why participate?

- Become a pioneer by committing yourself to a social issue that is not often addressed in the Grand Duchy

- Reduce the costs associated with handling over-indebtedness situations through more effective prevention

- Contribute to the well-being of your employees

The project's stakeholders

Volunteer companies

Volunteer companies

Are confronted with the issue of over-indebtedness and wish to have solutions to better take care of and support their customers and/or employees

Crésus - France

Crésus - France

Helping and accompanying people in situations of social and financial exclusion for more than 20 years

Developed innovative financial education and support programs in collaboration with the private sector

IMS Luxembourg

IMS Luxembourg

Has been working on the subject of over-indebtedness since 2017

Gathers relevant stakeholders to move from challenge to solution

Facilitates and encourages the emergence of initiatives

The working group meetings

- July 10th 2019 at CREOS Luxembourg

Presentation of the working group’s objectives and meeting with our partner Crésus - Next meeting : 13 September

For more informations, contact Priscilia Talbot.

The projects imagined by the participants

MOBILE APPLICATION FOR FINANCIAL LITERACY

Solution: change the budget management and financial literacy in a positive way through the development of a fun financial literacy mobile app

PREVENTION TOOL FOR OVER-INDEBTEDNESS

Solution: developing an analysis tool that would allow organisations to detect risky profiles among the customers or employees in order to prevent over-indebtedness situations through a budgetary support

NATIONAL AWARENESS CAMPAIGN

NATIONAL AWARENESS CAMPAIGN

Solution: national awareness-raising campaign shattering the taboo on over-indebtedness and encouraging people with financial difficulties to turn to the competent services

We have gathered several resources and documents on the topic of over-indebtedness and on the specific context in the Grand-Duchy.

The new thematic report on over-indebtedness in Luxembourg summarizes the work and discussions of the four workshops. It gives an overview of the issue of over-indebtedness in Luxembourg : key figures and information, progress of the workshops and concrete solutions.

The new thematic report on over-indebtedness in Luxembourg summarizes the work and discussions of the four workshops. It gives an overview of the issue of over-indebtedness in Luxembourg : key figures and information, progress of the workshops and concrete solutions.

A database is also available on request for IMS members or participants of the workshops. It provides information on the different projects, the history of the workshops and general information on the fight against over-indebtedness in Luxembourg :

- Resources and data on over-indebtedness

- Expertise and good practices

- Project note

November, 17 of 2017 : What progress was made on the issue of over-indebtedness after four co-creation workshops?

July, 13 of 2017 : Back on the first co-creation workshop on the theme of over-indebtedness